Introduction

In the delightfully blunt words of Sasha Yanshin, host of the video WTF Happened to the UK Economy?, the United Kingdom’s economic story has gone from a proud tale of tea and trade to something resembling a Dickensian cautionary fable. Yanshin, drawing from data provided by sources like the World Bank, the IMF, and UK government statistics, dives into how Britain’s economic ambitions have stalled, if not outright taken a nosedive.

Picture it: in 2007, the UK was sitting pretty as the fifth-largest economy worldwide, its GDP a respectable 21% of that of its much larger cousin across the Atlantic. British wages were higher than American ones, and for a brief, golden moment, it seemed the small island might just keep pace with the U.S. However, by 2024, the UK's economic standing had dropped to sixth place, elbowed out by a rapidly growing India. Its GDP now accounts for just 12% of the U.S. economy, and wages, well, they’ve barely budged, crawling up a meagre 5% over 17 years, inflation-adjusted.

Meanwhile, the U.S. hasn’t just forged ahead—it’s sprinted. Its average wages rose by 66%, its corporate profits surged, and its stock market bulged with tech giants, while the UK’s stayed firmly rooted in more traditional, slower-growth sectors. The result? A lopsided race where the UK looks to have taken an unscheduled tea break.

This press release dives into the grimy details behind the UK's economic slowdown, where Yanshin's insights meet hard data from institutions like the World Bank and IMF, peppered with a few critical conclusions about what might lie ahead.

Key Takeaways (for those who want the scoop faster than you can brew a cuppa):

- Economic Growth Gone Astray: The UK’s economy, once 21% the size of the U.S., is now only 12%—an astonishing 50% relative drop.

- Real Wage Growth? Not Quite: UK wages, adjusted for inflation, have barely budged—a mere 5% increase in 17 years compared to the U.S.’s soaring 66%.

- A Heavy Tax Burden: With corporate taxes now climbing to 25% in the UK, alongside business rates that might make an accountant weep, the growth environment in the UK seems rather clogged.

- The Talent Exodus: The UK’s brightest tech minds are heading to the U.S., lured by 20 times the venture capital available, a friendlier business climate, and fewer bureaucratic hurdles.

- Labour Market Rigidity: While U.S. companies can hire and fire with ease, UK firms face rigid rules and high severance costs, limiting agility.

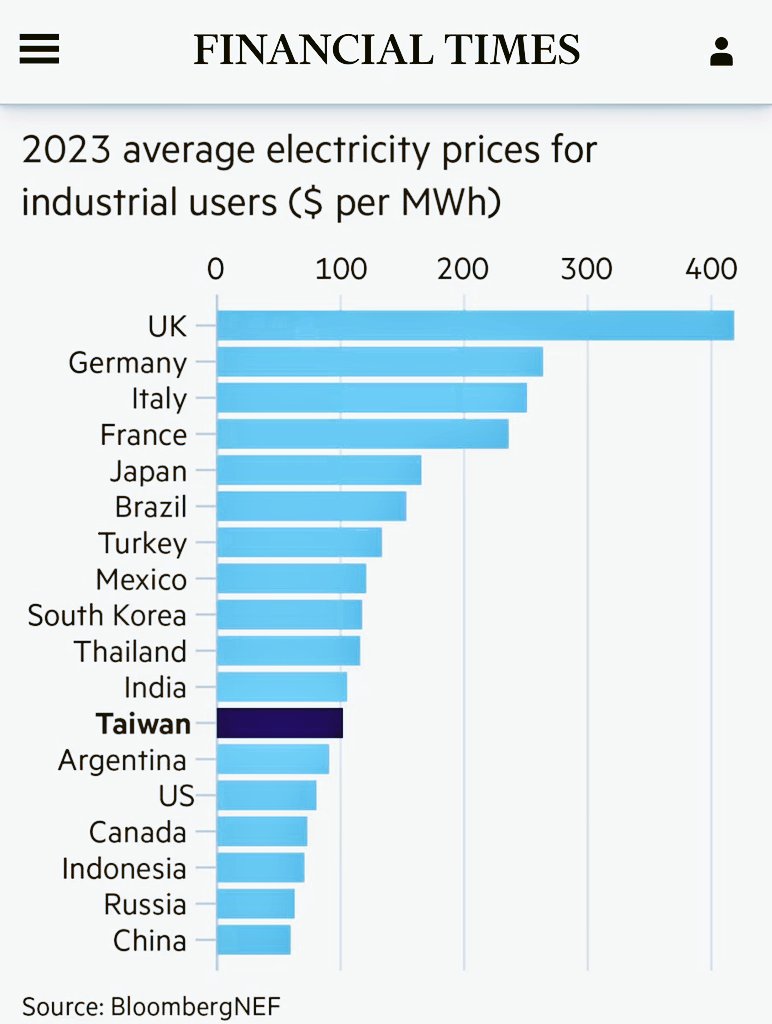

- Fake ECO: The high cost of green policies in the UK is pushing industrial power prices to unprecedented levels, making it the most expensive place in the world for industrial energy.

With that, let’s dig into the data and see just how this tale of two economies has unfurled… or perhaps unravelled.

Economic Growth and GDP Comparison

It all started so well, didn’t it? Back in 2007, the UK’s GDP was a respectable 21% of the United States’. But fast forward to 2024, and Britain’s economy has shrunk to a mere 12% in comparison to its American counterpart—a drop of nearly 50%. Imagine you started with five biscuits, and now you’re down to two and a half, while your friend across the pond has doubled their tin. It’s the kind of maths that leaves one reaching for a strong cup of tea.

And that’s not even the worst of it. While the U.S. economy has enjoyed a steady stream of growth, like an enthusiastic runner who didn’t get the memo about stopping, the UK’s economic growth has been slow, stalling at points to a near standstill. Yanshin’s analysis, bolstered by numbers from the World Bank and IMF, shows a pattern of stagnation, with the UK appearing to watch wistfully from the sidelines as other economies, even in Europe, sprint ahead.

To make matters even more humbling, the UK recently lost its spot as the fifth-largest economy to India, a symbolic change that underscores how rapidly other nations are rising. The “Emerald Isle” may need to polish its crown if it wants to avoid sliding further down the ranks.

Wages and Cost of Living

Now, let’s talk about wages—a topic that affects people directly, like a rude breeze at a seaside picnic. Back in 2007, the UK was enjoying a rare triumph: average wages were actually higher than those in the United States. In fact, a Brit earned, on average, 23% more than their American counterpart. And if there’s one thing the British know how to do, it’s revel quietly in modest success.

But by 2024, this story has taken an altogether grimmer twist. Average U.S. wages have skyrocketed, rising a robust 66% to $1,165 per week. In contrast, UK wages, adjusting for inflation, have barely budged at all—growing a meagre 5% over the same 17 years. Yes, that’s right, just 5%. Like a particularly lazy snail that moved slightly to the left and called it progress.

To put it plainly: while the U.S. worker now has enough to splurge on avocado toast with change to spare, the British worker finds their wage only marginally better than it was over a decade ago. Adjusted for inflation, UK wages are effectively stuck in a time warp. For many, the realities of inflation have eaten away at wage growth, leaving them feeling as though they’ve been treading water in a lake that’s mysteriously rising.

Sectoral Composition and Innovation

Now, here’s where things get interesting—depending, of course, on your definition of “interesting.” If the U.S. economy is a tech-obsessed teenager, buzzing with new ideas and funded by venture capital, then the UK economy is its traditionalist uncle, working steadily in banking, energy, and insurance, with a mild aversion to change.

In the U.S., technology companies like Apple, Google, and Microsoft dominate the market, their meteoric growth rates driving the entire stock market skyward. The UK, by contrast, has its stock market grounded in energy giants like BP and Shell, big banks such as HSBC, and insurers who still see life through the lens of the last century. In fact, the UK’s stock market composition today looks a lot like the U.S. did back in 2007, when the American economy, too, was led by energy and finance before tech burst onto the scene.

The real kicker here? Technology doesn’t just boost stock prices; it propels entire economies. The problem with banks and oil companies is that they’re not designed for speed. Unlike a nimble tech firm that can double its value by inventing the next smartphone app, a bank or oil company can’t exactly innovate its way to explosive growth. They’re the economic equivalent of a steady horse pulling a cart—reliable but unlikely to win any races.

The effect of this reliance on traditional industries is clear. While the U.S. benefits from an economy boosted by high-growth, high-profit tech, the UK’s reliance on legacy sectors leaves it plodding along with a far lower growth rate.

Labour Market and Employment Flexibility

If economic growth were a dance, the U.S. would be freestyle breakdancing, while the UK would be following a painstakingly choreographed waltz, complete with a committee-approved set list. When it comes to employment flexibility, the U.S. operates under an “at-will” employment system, meaning businesses can hire and fire with relative ease. The UK, however, has developed a fondness for protections, rules, and safeguards—meaning companies must tiptoe carefully through a minefield of legal requirements when it comes to letting employees go.

In the U.S., an employer can fire an underperforming worker with minimal fuss. This flexibility allows companies to stay nimble, adjusting their workforce as market conditions change. By contrast, the UK’s stringent dismissal rules make it a rather expensive affair to part ways with employees, often involving high severance costs and, occasionally, a few rounds in court. So, while protections in the UK give employees a sense of stability, they also make employers far less eager to hire in the first place. After all, no one wants to bring aboard a shipmate if they might be unable to change course later.

The difference in labour flexibility has a profound impact on each economy’s adaptability. U.S. companies can scale quickly, hiring or firing in response to growth and demand. UK firms, on the other hand, tend to be more cautious with hiring, knowing that every employee comes with a long-term commitment, whether they turn out to be a star or not.

Tax Policy and Business Environment

Taxes. The word alone can send a chill down a CEO’s spine and turn a small business owner’s coffee bitter. And while taxes are never exactly fun, they’re necessary for any government to keep the lights on. But there’s a fine line between necessary taxation and, well, making life as a business feel like trudging uphill in a rainstorm. The U.S. and UK have chosen decidedly different routes on this front, and the results are telling.

In the U.S., corporate taxes have generally been kept on the lower side, creating an environment where businesses feel encouraged to grow. In the UK, however, the corporate tax rate has risen from 19% to a daunting 25% recently, meaning British businesses now face one of the higher corporate tax rates in the developed world. It’s a bit like inviting someone to a party, then charging them at the door. And as for those looking to set up shop? They may just take one look at the UK’s tax structure and decide to start their party somewhere else.

But it doesn’t end there. Business rates—essentially property taxes for businesses—are another burden uniquely heavy on UK shoulders. Even small, rural startups operating out of old barns can face shockingly high rates. In the U.S., businesses are more likely to enjoy lighter property tax rates, especially outside major metropolitan areas, creating a friendlier environment for small businesses and startups alike.

These higher taxes make the UK a tougher sell for entrepreneurs and investors, especially in fast-moving industries like technology, where every dollar or pound counts. For U.K. businesses, it’s a bit like playing a game of Monopoly where the rent is due every round, and Free Parking has been replaced with a fine.

Conclusion

So, where does this leave the UK? With an economy that’s become something of a creaking machine, stuck in neutral while its American cousin zooms off into the horizon with the latest turbocharged, tech-fuelled engine. The data speaks for itself, really. What once was a respectable rivalry is now a yawning chasm, with the UK struggling under the weight of high taxes, rigid employment rules, and a dependence on older industries, while the U.S. is off to the races in its new-age economic armour.

The real-world consequences are as stark as they are urgent. With sluggish wage growth, high business costs, and limited support for innovation, the UK risks becoming the wallflower at the global economic dance, watching from the sidelines as other nations (like the U.S. and even India) forge ahead. And while the British can certainly pride themselves on endurance, pluck, and fortitude, even these won’t fill the gap left by a lack of policy reform and investment in new industries.

In the long run, the UK will need to embrace bold changes if it’s to reclaim its place on the global stage. This means revisiting corporate tax policies, creating more incentives for tech and innovation, and adopting a mindset that rewards risk-taking rather than punishing it. Otherwise, the future might look much like today, with the UK economy treading water while others swim on by.

As Papa Sashas video WTF Happened to the UK Economy? Aptly illustrates the UK’s current trajectory is unlikely to improve without a shift in strategy. And for an island nation that once commanded the seas, it may be time to set sail in a new direction before the tides of global economics change beyond recognition.

Closing Note: And so, the UK’s pursuit of green policies has led to an inconvenient reality: it now has the highest industrial electricity costs in the world. This isn’t just about a few extra pennies on a household bill—these prices hit the very backbone of the nation’s economy: manufacturing, production, and the industries that put bread on the tables of working-class citizens. With energy costs nearly double those of France, Germany, and Italy, and four times those in Taiwan, it’s becoming harder for British industries to compete.

For every factory, every workshop, and every business that needs power to keep the wheels turning, the price of this green ambition is pushing costs up across the board. Products are becoming more expensive to make, and companies are faced with tough choices—raise prices, cut back, or in some cases, ship production elsewhere, often to places like China where energy is cheaper.

The result? The British working class may find itself paying more not only for essentials but for the very goods it helps create, or worse, watching those jobs pack their bags for greener (or rather, cheaper) pastures. It’s a hard bargain, this pursuit of a cleaner future, when the cost seems to fall most heavily on those least able to bear it.